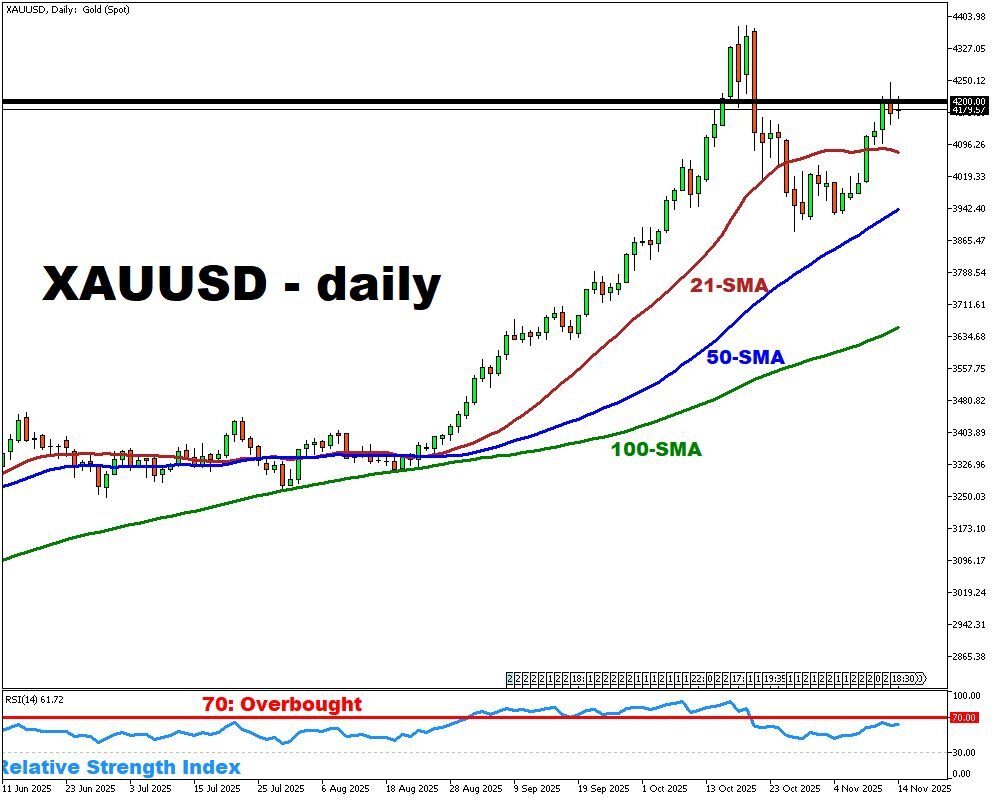

Gold reaches above $4,200 as data delays cloud outlook

- Gold moves above $4,190 per ounce

- Dollar softness supports recent gains

- U.S. data backlog adds economic uncertainty

- Fed signals limited inclination to ease

- Market odds for Dec. cut near 50%

Gold (XAU/USD) rose above US $4,200 per ounce on Friday, placing the metal on track for its strongest weekly performance in nearly a month.

The advance followed renewed softness in the U.S. dollar and growing uncertainty surrounding the release of several key economic indicators.

After the U.S. government reopened, National Economic Council Director Kevin Hassett noted that some October data may “simply never show up,” as certain agencies were unable to collect information during the shutdown. The combination of missing or delayed figures has contributed to a more opaque picture of near-term economic momentum.

At the same time, gold’s upside remained limited as Fed officials expressed little indication of shifting toward more substantial policy easing.

Market-implied probabilities for a December interest-rate reduction have been recalibrated to roughly 50%, down sharply from over 95% a month earlier. Expectations for cuts further out, including those anticipated in 2026, showed little movement.

The metal’s recent price action reflects a market environment where currency fluctuations, policy signals, and data uncertainty continue to intersect without offering clear direction.