- RBA decision may drive AUDUSD volatility

- FOMC minutes key for US500 market direction

- WTI reacts to oil data, trade deal news

- July 9 deadline could impact global trade

Markets are positioning ahead of a pivotal week featuring the RBA Interest Rate Decision, the FOMC minutes, oil data and the July 9th trade deal deadline – events that could reshape monetary policy expectations and global trade dynamics.

With market uncertainty in the air, investors are seeking direction on the Fed’s and RBA's next moves, as well as clarity on trade policy. AUDUSD, US500, and WTI Crude remain highly reactive to shifting macro signals. Any surprises could drive meaningful cross-asset repricing.

Events Watchlist:

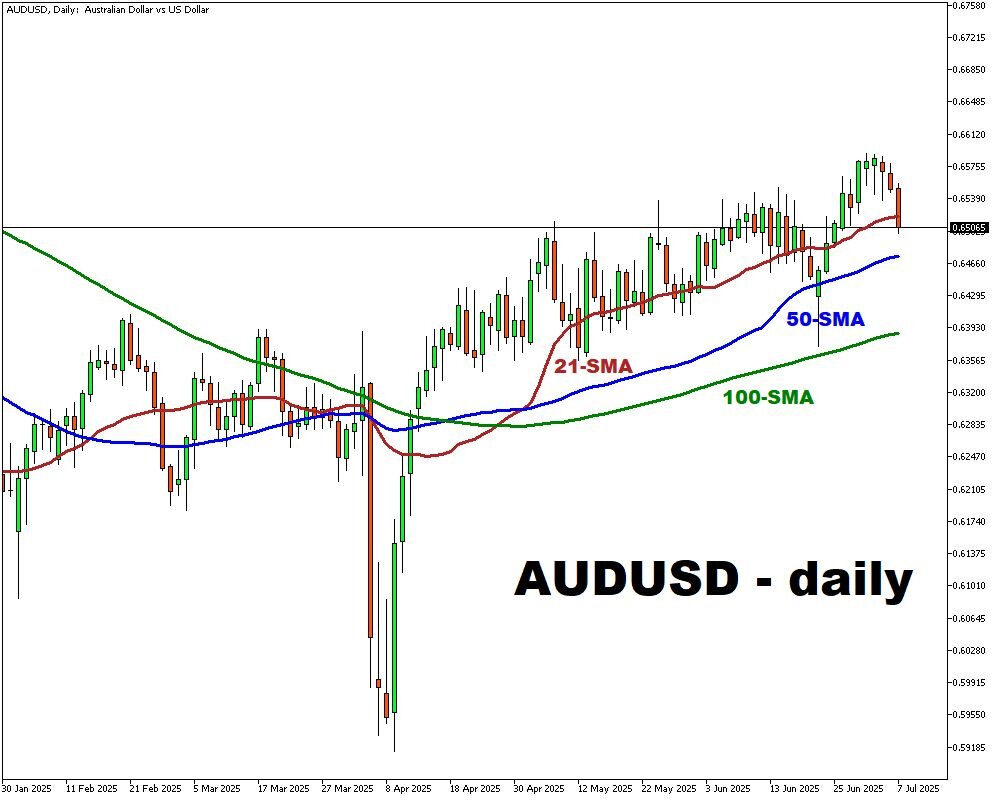

Tuesday, July 8th: RBA Interest Rate Decision - AUDUSD

The RBA Interest Rate Decision on Tuesday will be key for AUDUSD. If the RBA strikes a more hawkish tone or signals policy concerns, AUDUSD could push higher toward/above 0.6601. A dovish or neutral stance may trigger downside toward 50-day MA, especially if paired with renewed global trade concerns midweek.

Wednesday, July 9th: FOMC Minutes – US500 Index

Equities are watching Fed commentary. A dovish read on the FOMC minutes could push US500 Index toward the new ATH. On the other side, if the Fed maintains a firm cautions tone, we may see US500 pullback toward 6,150 level.

Tuesday-Wednesday, July 8–9th: API and EIA Crude Oil Stocks Change – WTI Crude Oil

Following the July 5 OPEC+ meeting, WTI will remain sensitive to U.S. inventory data and the upcoming July 9 trade deal deadline. A larger-than-expected drawdown in API or EIA stockpiles could support prices, while rising inventories or renewed demand concerns tied to tariff developments may weigh on WTI.

Here’s a comprehensive list of other key economic data and events due this week:

Monday, Jul 7

- JPY: Japan, Current Account (May)

- GER40: Germany, Industrial Production (May)

- EUR: Eurozrea, Retail Sales (May)

- GBP: UK, Halifax House Price Index (Jun)

Tuesday, Jul 8

- AU200: Australia, RBA Interest Rate Decision; NAB Business Confidence (Jun)

- EUR: Germany, Balance of Trade (May)

- CAD: Canada, Ivey PMI s.a (Jun)

- WTI: API Crude Oil Stock Change (w/e Jul 4)

Wednesday, Jul 9

- JPY: Japan, PPI (Jun); Stock Investment by Foreigners (w/e Jul 5); Foreign Bond Investment (w/e Jul 5)

- AUD: Australia, Westpac Consumer Confidence Change & Index (Jul); RBA Chart Pack

- NZD: New Zealand, RBNZ Interest Rate Decision

- CNY: China, Inflation Rate (Jun), PPI (Jun)

- GBP: UK, Treasury Gilt 2035 Auction; RICS House Price Balance (Jun)

- MXN: Mexico, Inflation Rate (Jun)

- USD: US, FOMC Minutes; Wholesale Inventories (May)

- WTI: EIA Crude Oil Stocks Change (w/e Jul 4)

- US' Trade Deals Deadline

Thursday, Jul 10

- JPY: Japan, 20-Year JGB Auction

- NZD: New Zealand, Business NZ PMI (Jun)

- US500: US 30-Year Bond Auction; Initial Jobless Claims (w/e Jul 5); San Francisco Fed President Speech; St Louis Fed President Speech

- MXN: Mexico, Monetary Policy Meeting Minutes

- NG: EIA Natural Gas Stocks Change (w/e Jul 4)

Friday, Jul 11

- AU200: Australia, Consumer Inflation Expectations (Jul)

- CHINAH: China, Vehicle Sales (Jun)

- SG20: Singapore, GDP Growth Rate (Q2)

- CHF: Swiss, Consumer Confidence (Jun)

- UK100: UK, GDP (May); Goods Trade Balance (May); Industrial & Manufacturing Production (May)

- CAD: Canada, Unemployment Rate (Jun); Average Hourly Wages (Jun)

- WTI: Baker Hughes Oil Rig Count (w/e Jul 11)

Saturday, Jul 12

- CNY: China, Balance of Trade (Jun)

Sunday, Jul 13

- JPY: Japan, Machinery Orders (May)