This Week: BoE rate decision & Trump’s tariffs in focus

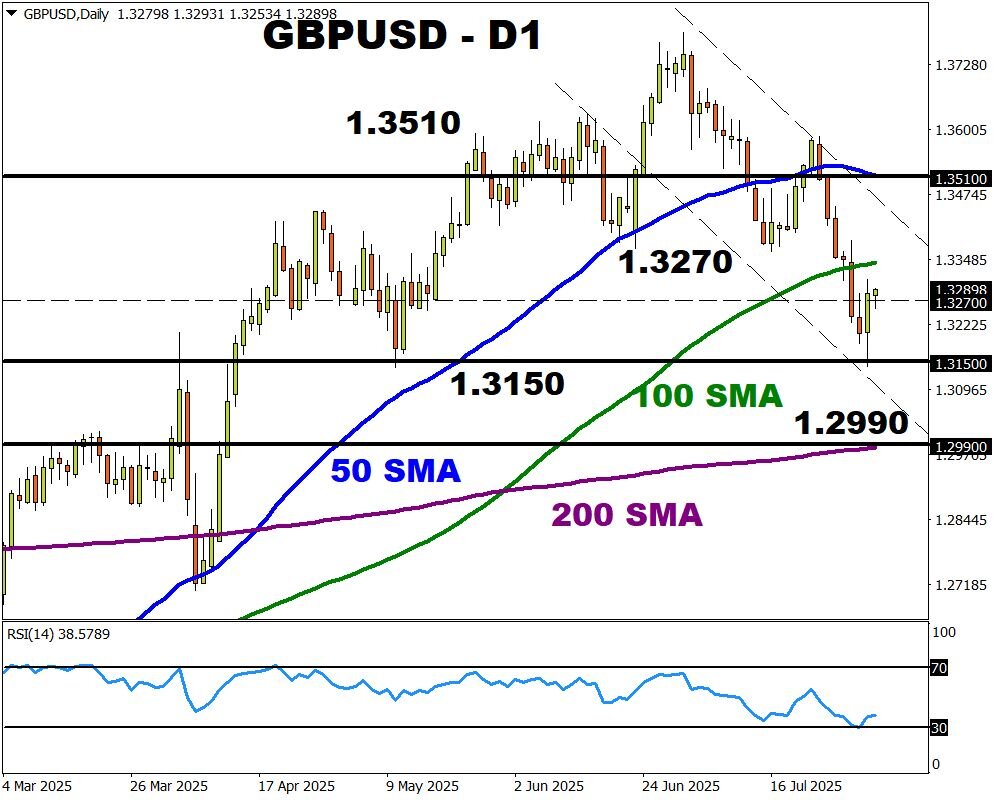

- GBPUSD ends July 3.8% lower – worst month in 2025

- BoE expected to cut rates by 25bp on Thursday

- BoE meeting forecast to move GBPUSD ↑ 0.5% & ↓ 0.4%

- Trump's updated tariffs take effect on 7th August

- Risk aversion could boost safe-haven assets

A pivotal week lies ahead for global markets amid renewed tariff uncertainty.

Trump has signed an executive order that imposes new tariffs on dozens of countries, which will go into effect on August 7th. After the soft US jobs report last Friday, traders will be closely watching the Bank of England’s interest rate decision and Switzerland’s unemployment data for cues on monetary policy paths and economic resilience.

In this backdrop, GBPUSD and USDCHF may experience heightened volatility as investors position around policy divergence and growth signals.

Event Watchlist:

GBPUSD

The Bank of England is expected to cut interest rates by 25bp on Thursday.

So, investors will be looking for clues on future policy moves.

Note: The latest UK CPI report increased to 3.6% in June, up from 3.4% in May.

Traders are currently pricing in a 97% probability that the BoE cuts rates in August with the odds of another rate cut by November at 77%.

- The GBPUSD may push higher toward the 100-day and 50-day SMA if BoE governor Bailey expresses caution over future cuts.

- Should the BoE cut rates and signal further cuts in H2, this may send the GBPUSD lower toward 1.3150.

GBPUSD is forecasted to move 0.5% up or down 0.4% in a 6-hour window after the BoE rate decision.

Bloomberg’s FX model forecasts a 74.5% chance that GBPUSD will trade within the 1.3133 – 1.3446 range, using current levels as a base, over the next one-week period.

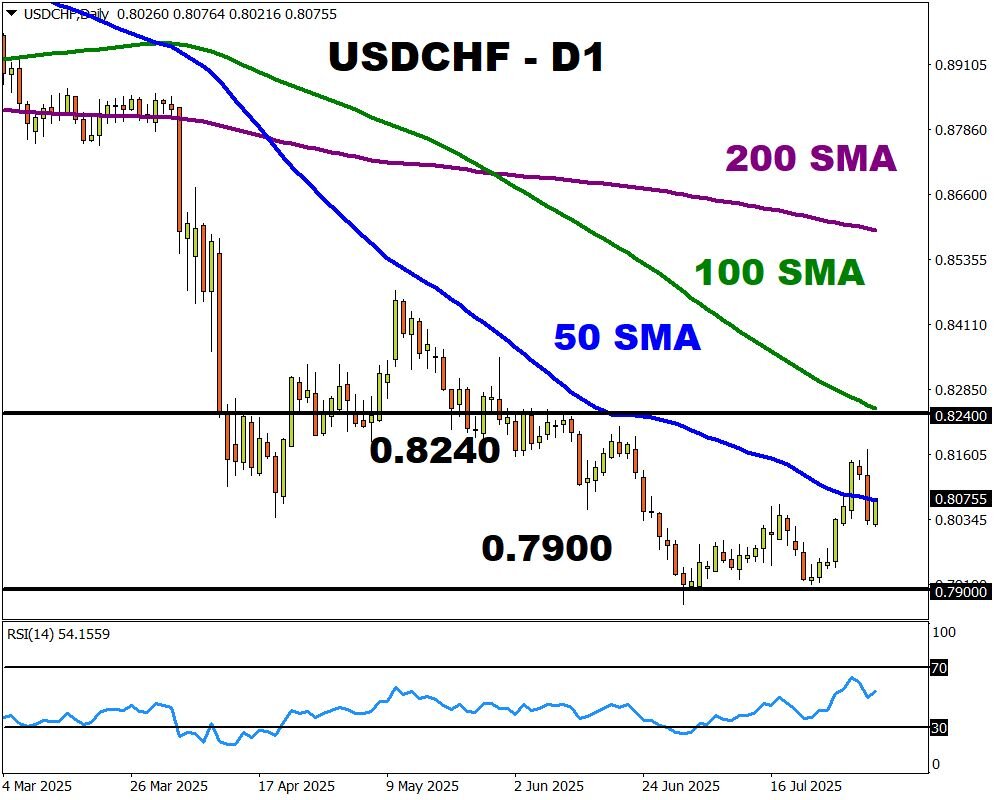

USDCHF

The Swiss unemployment rate will be key for CHF direction, especially after Trump slapped Switzerland with 39% tariffs. A weaker-than-expected figure may validate the SNB’s dovish stance, sending USDCHF higher toward resistance near 0.8240. On the flip side, an upside surprise could support CHF, pulling USDCHF down toward the 0.7900 area.

Here’s a comprehensive list of other key economic data and events due this week:

Monday, 4th August

- US500: US factory orders, durable goods

Tuesday, 5th August

- CN50: China S&P Global services PMI

- EU50: Eurozone PPI, HCOB services PMI

- JP225: Japan BOJ meeting minutes

- US500: US trade, ISM services, S&P Global services PMI

- UK00: BP earnings

Wednesday, 6th August

- EUR: Eurozone retail sales

- GER40: Germany factory orders

- TWN: Taiwan CPI

- US30: Disney earnings

Thursday, 7th August

- AUD: Australia trade

- CN50: China trade, foreign reserves

- CHF: Swiss unemployment rate

- GER40: Germany industrial production

- GBP: BoE rate decision

- USDInd: US initial jobless claims, Atlanta Fed President Raphael Bostic speech

- Trump's updated tariffs come into effect

Friday, 8th August

- CAD: Canada unemployment

- JP225: Japan household spending, trade, current account

- TWN: Taiwan trade