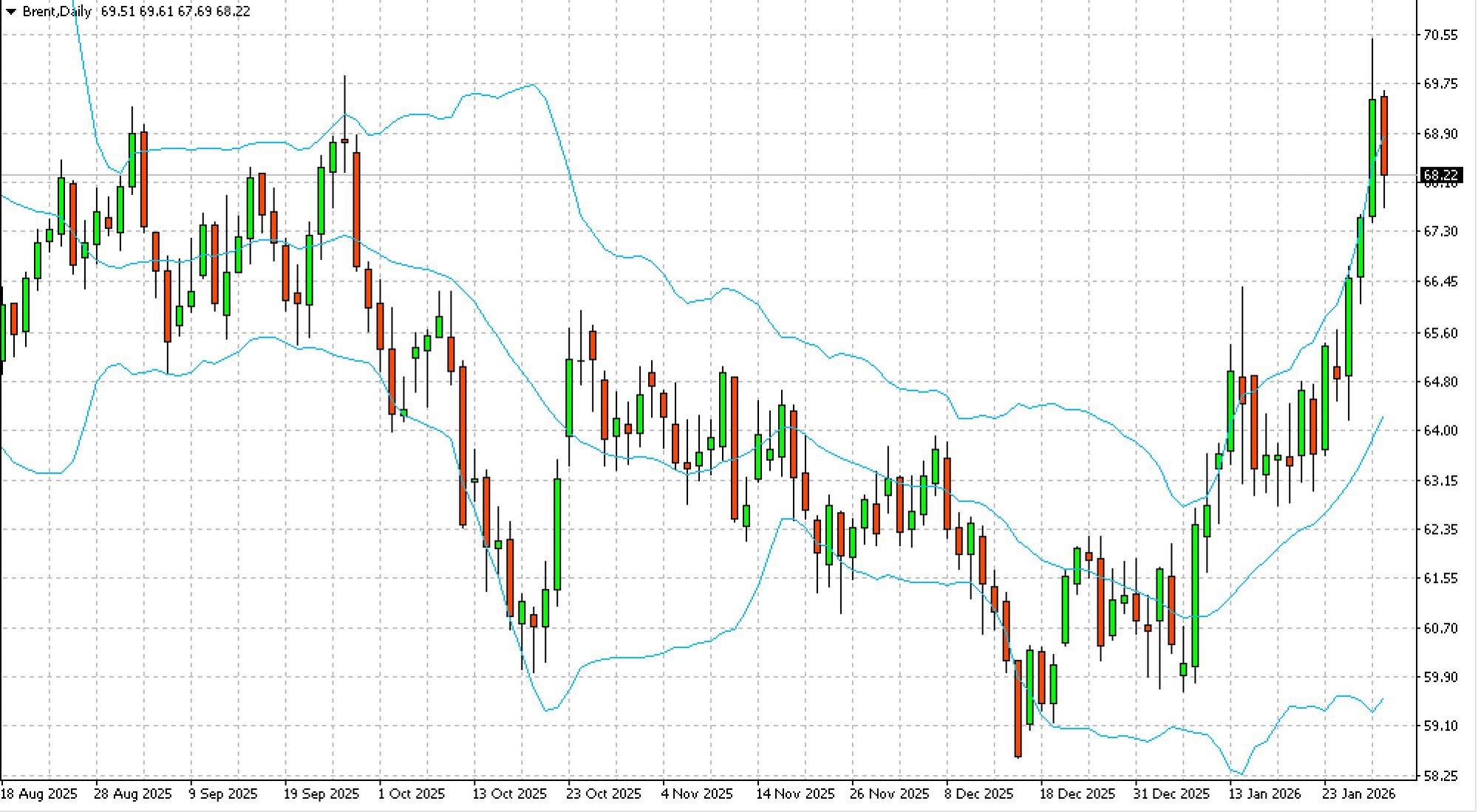

Brent Oil Pulls Back from Highs

- Brent crude returned to $69.86 per barrel on Friday

- Best monthly gain since July 2023

- Gains supported by geopolitical risk premium

- Risks to shipping through the Strait of Hormuz

- Supply disruptions also contributed to the rise

The price of Brent crude returned to $69.86 per barrel on Friday.

Technically, on the daily timeframe, Brent is poised to consolidate above $69.50.

For the month, commodity prices remain on track for their best monthly rise since July 2023. Quotes are supported by a growing geopolitical risk premium.

Concerns stem from renewed tensions between the US and Iran after US President Donald Trump called on Tehran to return to nuclear negotiations. The Iranian side warned of possible retaliatory measures.

The market is focused on the potential impact of these risks on shipping through the Strait of Hormuz – a narrow sea corridor between Iran and the Arabian Peninsula that is crucial for global energy supplies. Tankers carrying oil and LNG pass through it daily.

Earlier in the month, prices were supported by geopolitical risks in Venezuela, production disruptions in Kazakhstan, temporary US production shutdowns due to weather, and tightened American restrictions on purchases of Russian oil.

Despite expectations of a supply surplus, the combination of these factors has driven price increases since the start of the year.