Copper Slump Amid Moves by China and the U.S.

- Prices retreat from record highs

- Copper extends losses for a second day

- China cracks down on high-frequency trading

- U.S. tariff deferral adds further pressure

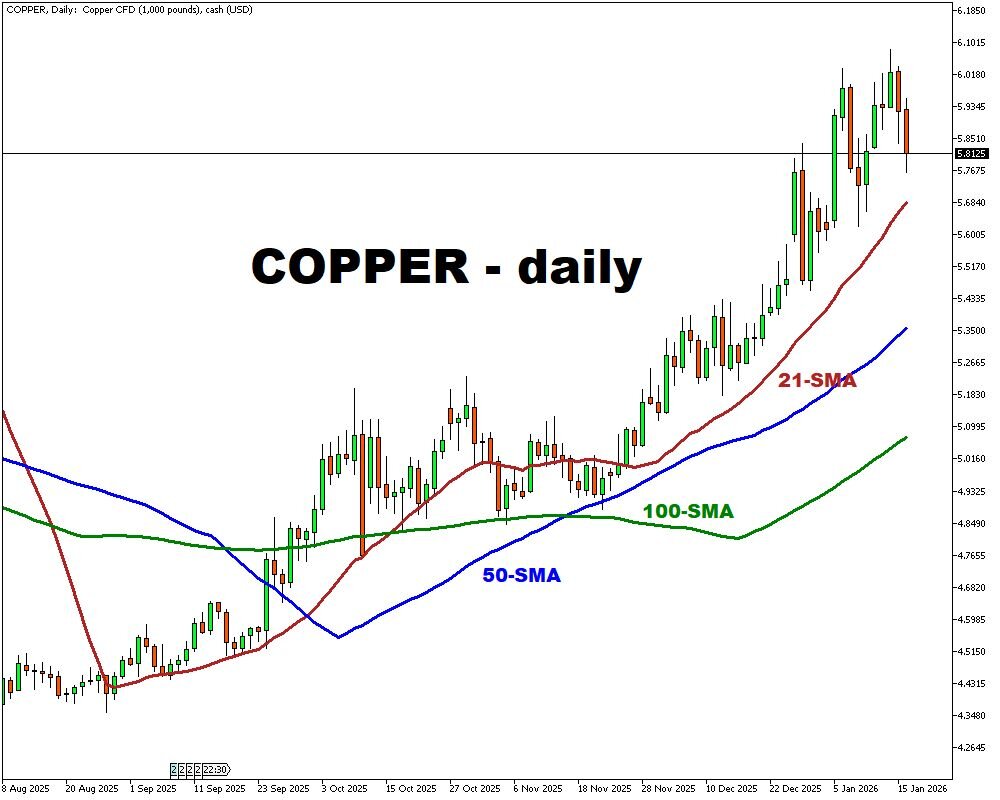

Confirming its status as one of the year's most volatile commodities, copper futures resumed their downward trajectory on Friday, slipping below the psychologically significant level of $5.90 per pound.

The driving force behind this corrective phase was an emergency decision by Chinese regulators aimed at drastically curbing high-frequency trading. As part of an unprecedented measure, domestic exchanges were ordered to physically remove third-party servers of algorithmic trading firms from their data centers, stripping them of their key competitive advantage—ultra-low latency in order execution. This move, targeted at reducing overall market risks, immediately triggered a wave of selling across all key trading platforms from Shanghai to London and New York, pulling the metal's quotes back from recent historic highs.

The situation was further complicated by Washington's decision to postpone the introduction of tariffs on strategic minerals, a list to which copper was added last year due to its indispensability for defense technologies and the modernization of the national energy grid.