Gold and Oil slide on shifting market forces

- Gold dips as strong jobs data dims rate-cut hopes

- Labor strength lifts yields, pressuring bullion

- Long-term gold outlook firm despite near pullback

- Oil slides on signals of conflict-talk progress

- Sanctions, supply risks add volatility to crude

Gold and oil are ending the week under notable pressure, each responding to a mix of shifting macro signals and evolving geopolitical dynamics.

Gold’s retreated below the $4,040/oz level after the delayed U.S. jobs report delivered a firmer-than-expected 119,000 increase in September payrolls, easing expectations for an imminent Fed rate cut.

Although unemployment edged up to 4.4% and wage growth held at 3.8%, the data reinforced the view that the labor market remains sturdier than previously assumed.

With several Fed officials urging patience and markets assigning only limited odds to a December cut, gold has become more sensitive to moves in real yields and the dollar, prompting short-term consolidation.

Even so, underlying support from persistent geopolitical risks and steady official-sector buying continues to underpin gold’s longer-term outlook.

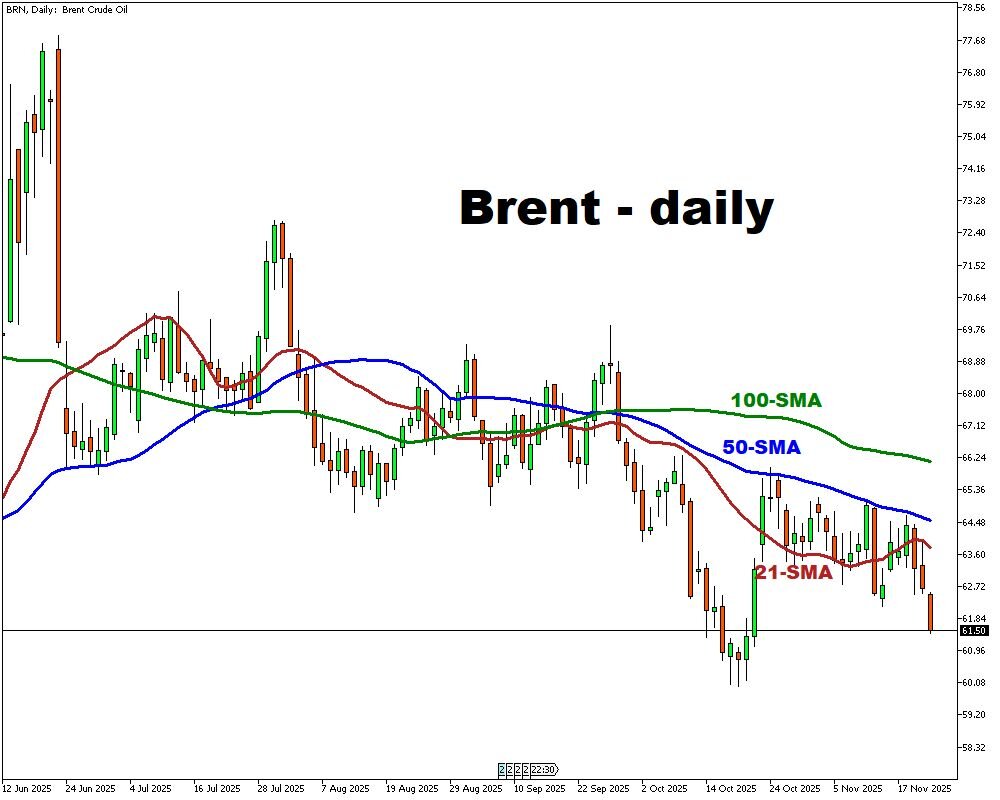

Brent crude has slipped below $62 per barrel, hitting a four-week low as traders react to indications that the Russia-Ukraine conflict may be moving toward a mediated peace framework.

The possibility of sanctions relief and a subsequent rise in Russian exports has stirred concerns about future oversupply, though European diplomats remain skeptical that negotiations will advance quickly.

At the same time, newly activated U.S. sanctions on Rosneft and Lukoil could leave millions of barrels stranded and force Indian refiners to diversify away from discounted Russian grades, injecting short-term tightness into an otherwise well-supplied market.