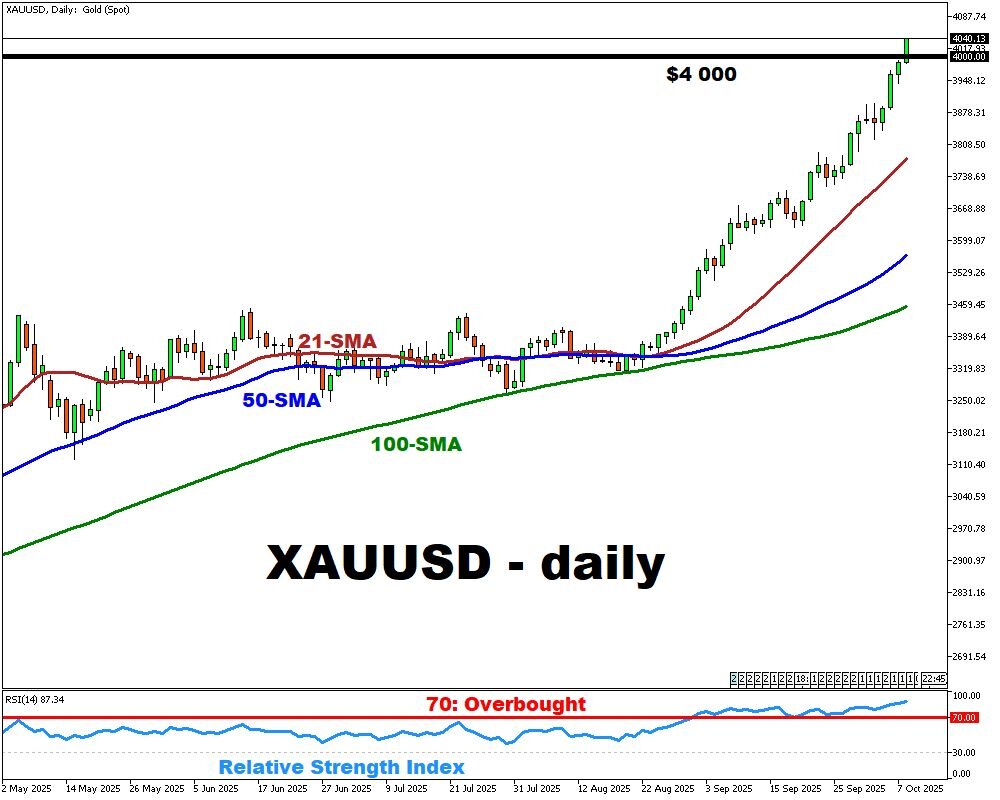

Gold breaks $4000!

- Gold hits record above $4000 mark

- Investors flee uncertainty

- Fed seen cutting rates twice in 2025

- Global turmoil boosts safe-haven flows

- Central banks, ETFs drive demand higher

On Wednesday, gold breached the $4,000 per ounce mark for the first time, setting a new all-time high as investors rushed into safe-haven assets amid heightened global uncertainty and dovish expectations for the US Federal Reserve.

The ongoing US government shutdown has delayed release of key economic indicators, complicating the Fed’s decision-making environment and amplifying volatility.

Yet the markets are already pricing in two 25-basis-point cuts — one in October and another in December.

External drivers, including political instability in France and a change in Japanese leadership, add extra layers of risk that further fuel safe-haven demand for gold.

Over 2025, gold has surged more than 50%, propelled by a weaker US dollar, trade frictions, and geopolitical shocks.

Central banks have remained major buyers, and recent inflows into gold-backed ETFs in September were the largest monthly influx in over three years.

Looking ahead…

The bullion market is riding strong momentum, underpinned by structural buyers and macro insecurity.

However, the rally’s sustainability depends heavily on continued dovish policy, further dollar weakness, and geopolitical tension. Should macro conditions reverse or the dollar strengthen, a pullback is possible.

Key potential support zones lie in the $3,700–$3,800 range, which may serve as cushions in any correction.