NZD Slips Following RBNZ Rate Decision Outlook

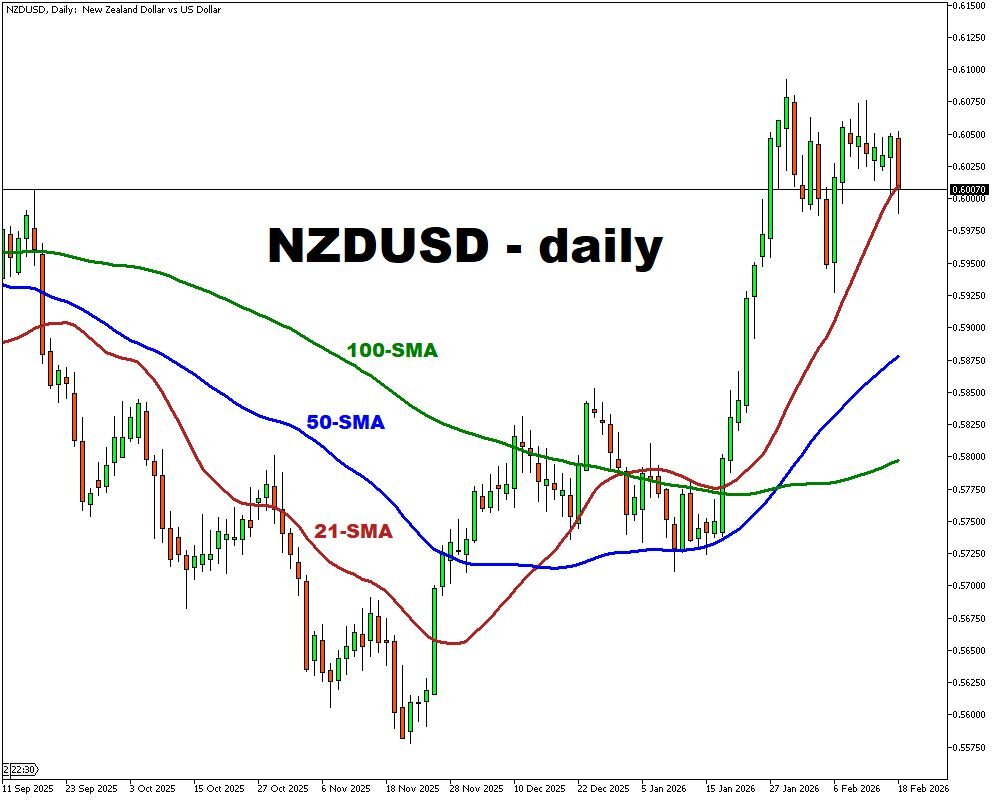

- Kiwi dollar dips 0.88% to ~0.5991 mark post announcement

- Central bank maintains supportive policy stance

- Rate hike forecasts shifted to later this year

- Attention turns to Governor Breman's comments

The New Zealand currency experienced downward pressure, trading near 0.5991 versus USD following the BRNZ's recent policy announcement.

Officials opted to keep benchmark rates unchanged while emphasizing an ongoing supportive stance. Although previous guidance suggested possible tightening far into the future, updated projections now hint at future adjustments within the current year, contingent upon economic recovery and inflation trajectories.

Despite this shift, policymakers express caution regarding the precise timing of stimulus removal. Consequently, market participants have adjusted their expectations, with probability models indicating a reduced likelihood of a rate increase by October compared to prior assessments.

While certain economic analysts speculate on earlier tightening measures, immediate focus remains on upcoming commentary from the central bank leadership.

This evolving landscape highlights the sensitivity of exchange rates to shifting central bank narratives and macroeconomic data interpretations without implying specific directional outcomes.