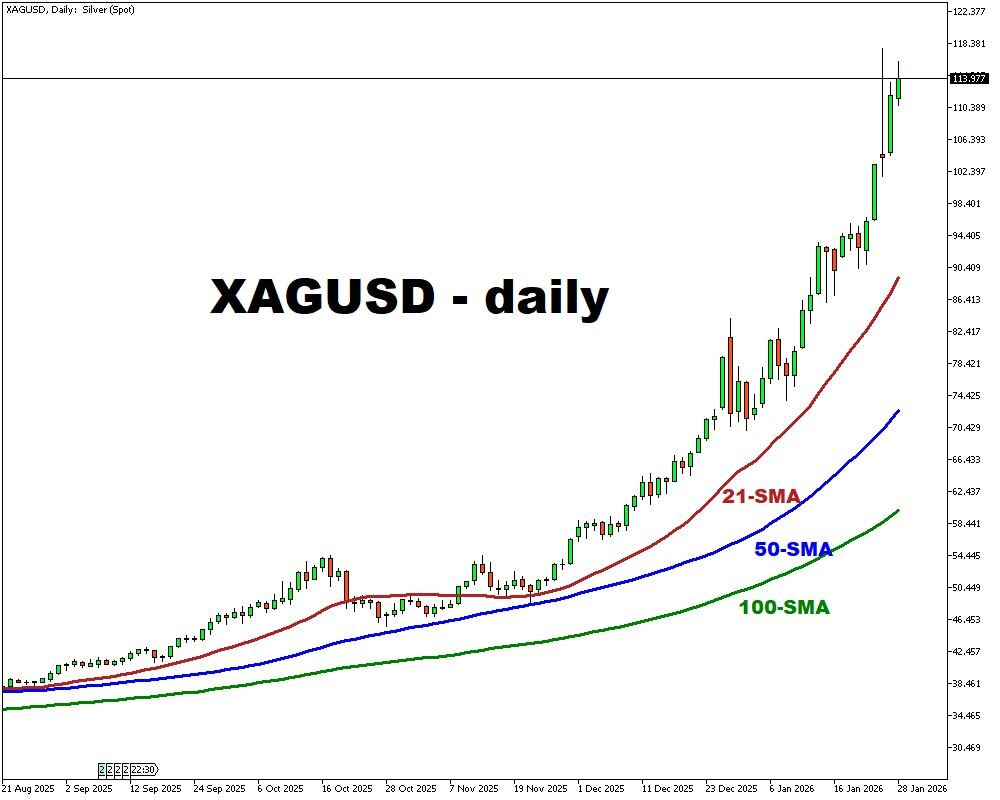

Silver Rides Dollar Weakness and Safe-Haven Demand

- Prices approach historic highs on dollar decline

- U.S. policy rhetoric fuels safe-haven metal flows

- Retail and industrial demand dynamics shift in Asia

- Macro uncertainties overshadow traditional fundamentals

The rally in silver prices reflects a potent confluence of macroeconomic forces and shifting market structures.

A significant driver is the pronounced weakness in the U.S. dollar, exacerbated by political commentary perceived as endorsing a softer currency. This dynamic, coupled with broader policy uncertainties, has amplified silver's appeal as a perceived store of value.

Concurrently, distinct regional fervor is evident. In China, exceptional retail investment demand has created notable market dislocations, exemplified by a major fund suspending trades after its price deviated sharply from net asset value.

This fervor is further illustrated by reported industrial shifts, with some manufacturers prioritizing investment-grade bullion production over jewelry.

These factors collectively underscore how silver is currently being propelled more by financial and geopolitical sentiment than by traditional industrial supply-demand metrics, creating a volatile and sentiment-driven price environment.