This Week: AUD RBA tone, US CPI impulse & UK growth check

- U.S. shutdown clouds FX markets, data disrupted

- RBA, U.S. CPI, UK GDP to guide major FX pairs

- Risk sell-off, U.S.–China tensions hit assets

- RBA tone, CPI data, UK growth to steer AUD, USD, GBP

As the new week unfolds, global FX markets wrestle with the uncertainty from the ongoing U.S. government shutdown, which has disrupted key data issuance and left investors “flying blind.”

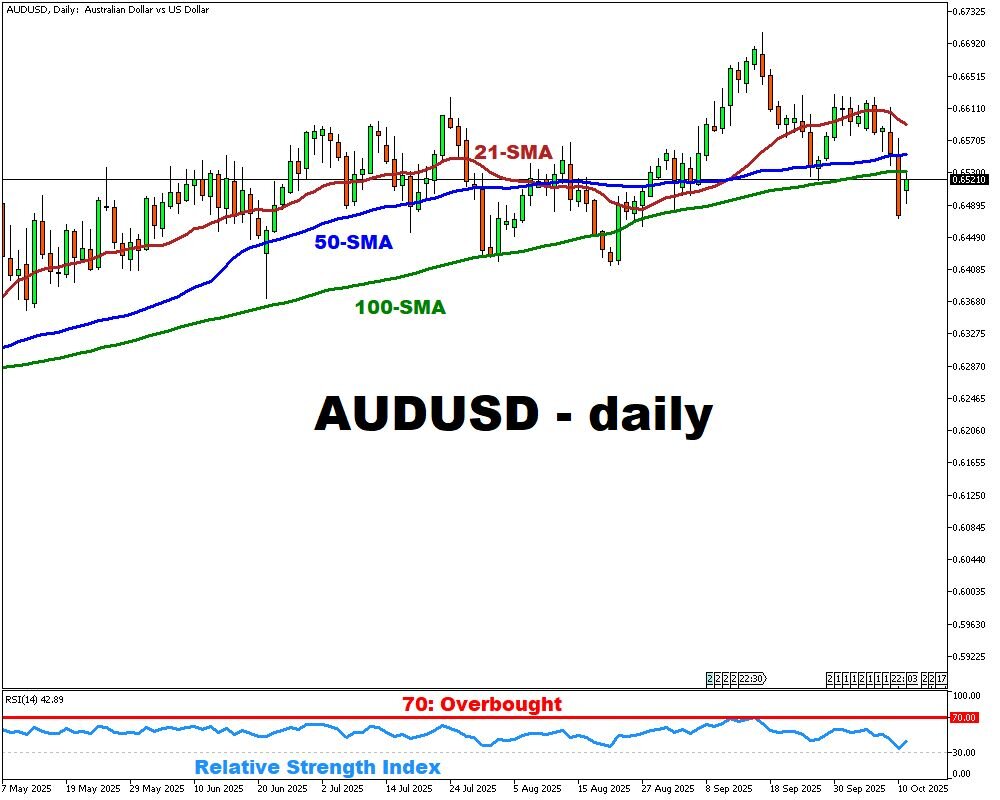

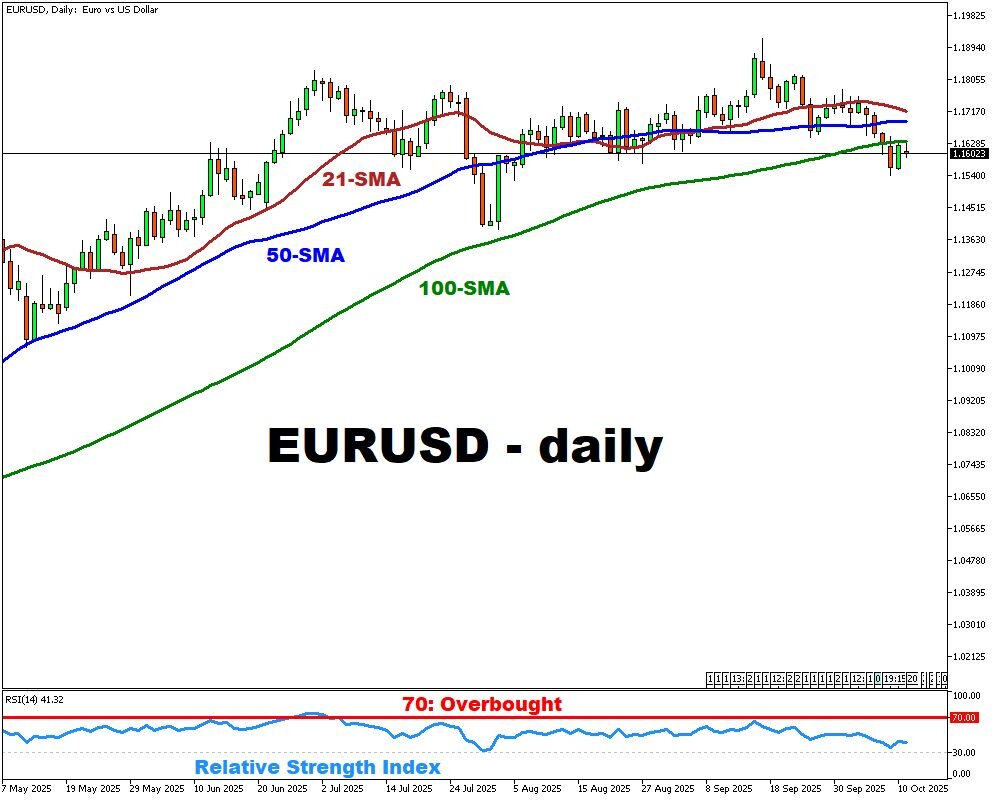

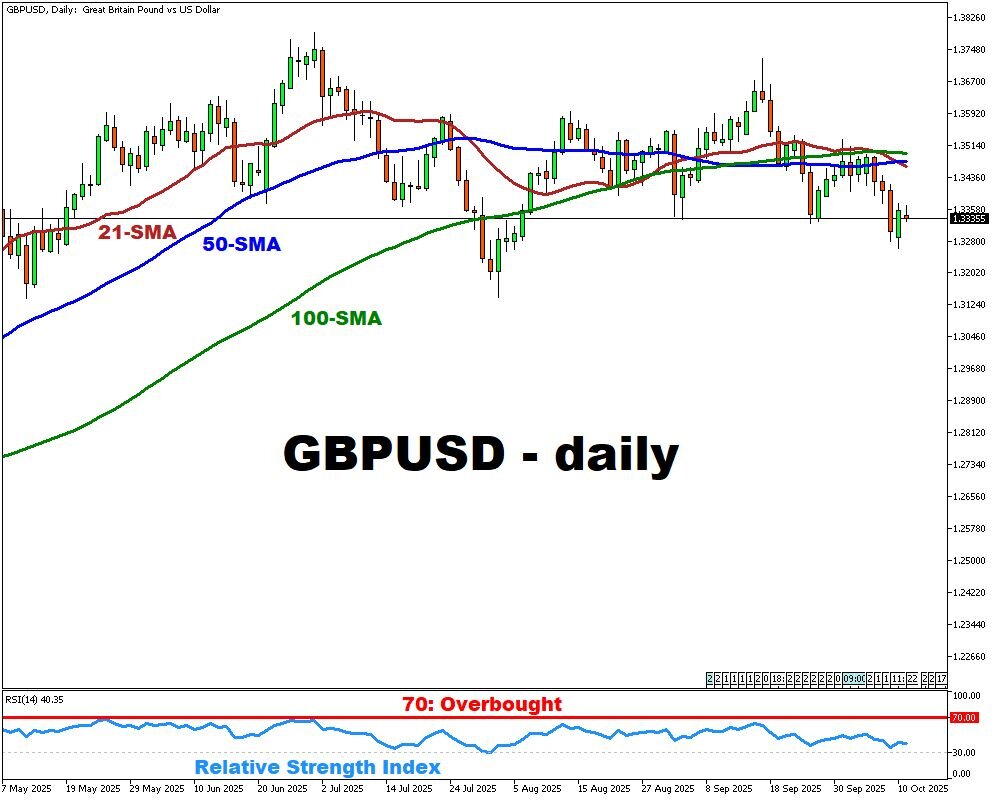

Amid that backdrop, three releases stand out as potential trend-changers: Australia’s RBA Meeting Minutes / NAB Business Confidence, the U.S. September CPI, and the UK’s August GDP. Together, these will anchor moves in AUDUSD, EURUSD, and GBPUSD as markets hunt for new directional cues.

Last Friday brought a sharp jolt to risk assets, with the S&P 500 and Nasdaq suffering their steepest one-day losses since April as renewed U.S.–China tariff tensions rattled sentiment.

Crypto markets mirrored the sell-off. Bitcoin and Ethereum fell sharply as leveraged positions unwound, underscoring the tight link between digital assets and broader risk appetite. These cross-market shocks may amplify FX volatility around this week’s RBA minutes, U.S. CPI, and UK GDP releases.

Events Watchlist:

Tuesday, Oct 14: RBA Meeting Minutes & NAB Business Confidence – AUDUSD

NAB’s August survey already showed business conditions rising to +7 while confidence cooled to +4, indicating mixed momentum. The minutes may reveal how much the Board is wrestling with upside inflation risks versus growth slowdown. Hawkish nuance or confident business tone could boost AUDUSD, while dovish lean or cautious commentary may cap upside.

Wednesday, Oct 15: U.S. CPI (Sep) – EURUSD

With many U.S. economic releases delayed or suspended, the CPI print takes on outsized importance for Fed policy expectations. This report may also be delayed due to the shutdown. Consensus is for Core CPI ~0.3% MoM and Headline YoY ~2.9-3.0%. A softer core will tug at dollar upside and favor EURUSD, while a hotter core could reassert hawkish Fed pricing and penalize EURUSD.

Thursday, Oct 16: UK GDP (Aug) – GBPUSD

The U.K. monthly GDP release is among the less encumbered datapoints this week, and markets will scrutinize whether the economy is holding up into Q4. A strong print could relieve sterling’s weakness by reducing expectations of BoE easing; a weak result would reinforce the cautious growth narrative around GBPUSD.

Other major events this week:

Monday, Oct 13

- CNY: China Balance of Trade (Sep)

- GBP: UK BRC Retail Sales (Sep)

- Crude Oil: OPEC Monthly Report

Tuesday, Oct 14

- AUD: Australia NAB Business Confidence (Sep); RBA Meeting Minutes

- UK Unemployment Rate (Aug); Avg. Earnings Incl. Bonus (Aug)

- EUR: Eurozone ZEW Economic Sentiment Index (Oct)

- GER40: ZEW Economic Sentiment (Oct)

Wednesday, Oct 15

- CNY: China Inflation Rate (Sep); Producer Price Index (Sep)

- EU50: Eurozone Industrial Production (Aug)

- USD: US Inflation Rate (Sep)

- WTI: US API Crude Oil Stocks Change (w/e Oct 10)

- JPY: Japan Machinery Orders (Aug)

Thursday, Oct 16

- AUD: Australia Unemployment Change (Sep)

- GBP: UK GDP (Aug); Goods Trade Balance (Aug); Industrial Production (Aug); Manufacturing Production (Aug)

- EUR: Eurozone Balance of Trade (Aug)

- US400: US PPI (Sep); Retail Sales (Sep); Initial Jobless Claims (w/e Oct 11)

- WTI: US EIA Crude Oil Stocks Change (w/e Oct 10)

Friday, Oct 17

- USD: US Building Permits (Sep); Housing Starts (Sep); Industrial Production (Sep)

Sunday, Oct 19

- NZD: New Zealand Inflation Rate (Q3)