This Week: RBNZ, FOMC Minute, Mexico Inflation and U.S. Govt. shutdown

- US Govt shutdown delays data, clouds guidance

- RBNZ rate cut likely; NZDUSD under pressure

- FOMC minutes eyed for dovish or hawkish tilt

- Mexico CPI to test Banxico’s easing stance

- Key global data, speeches to steer sentiment

As the new week unfolds, markets must navigate the added overhang of a U.S. federal government shutdown, which has already delayed some data releases (especially from the BLS/Dept. of Labor) and clouds forward guidance.

In that context, three events stand out as true market drivers: the RBNZ’s interest rate decision, the FOMC Minutes from September, and Mexico’s September CPI. These will anchor sentiment across FX, fixed income, and equity flows.

Events Watchlist:

Wednesday, Oct 8: RBNZ Interest Rate Decision – NZDUSD

The RBNZ currently holds its policy rate at 3.00% following its August cut, and markets expect further easing ahead. The base case is another 25-bps cut, but a more aggressive 50 bps move can’t be ruled out given weak GDP and soft global demand. A dovish tilt or bigger cut will likely pressure NZDUSD, while a smaller move or hawkish nuance could spark a reversal.

Wednesday, Oct 8: FOMC Minutes (Sept Meeting) – US500 Index

Released domestically at 18:00 GMT, the minutes from the September meeting will be scoured for signals on the labor vs inflation dynamics. Amid delayed data from shutdown disruptions, a dovish lean could favor equities, while hints of hawkish vigilance could shake investor’s sentiment.

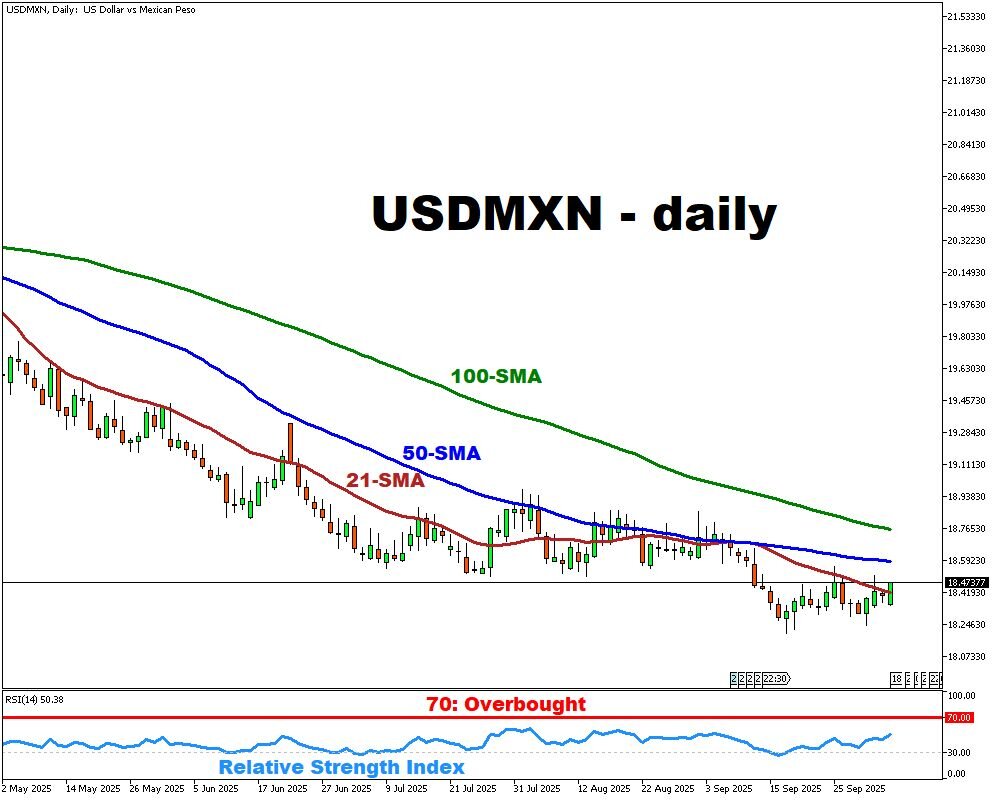

Thursday, Oct 9: Mexico CPI (Sep) – USDMXN

September’s early inflation print showed acceleration; with Banxico already cutting rates to 7.50% on September 25, this full-month release will test the bank’s easing narrative. A stronger than expected CPI would offer support to MXN, while a cooler print would give more comfort to further rate cuts and weigh on the peso.

Other major events this week:

Monday, Oct 6

- CHF: Swiss Unemployment Rate (Sep)

- GBP: UK S&P Global Construction PMI (Sep)

- MXN: Mexico Consumer Confidence (Sep)

- AUD: Australia Westpac Consumer Confidence Change (Oct)

- JPY: Japan Household Spending (Aug)

Tuesday, Oct 7

- GER40: Germany Factory Orders (Aug)

- FRA40: France Balance of Trade (Aug)

- CAD: Canada Ivey PMI s.a. (Sep); Balance of Trade (Aug)

- USD: US Balance of Trade (Aug); Atlanta Fed President Bostic Speech

- WTI: US API Crude Oil Stock Change (w/e Oct 3)

- JPY: Japan Current Account (Aug)

Wednesday, Oct 8

- AUD: Australia NAB Business Confidence (Sep); Westpac Consumer Confidence Index (Oct)

- NZD: RBNZ Interest Rate Decision

- EUR: Germany Industrial Production (Aug)

- USD: FOMC Minutes

- WTI: US EIA Crude Oil Stocks Change (w/e Oct 3)

Thursday, Oct 9

- EU50: Germany Balance of Trade (Aug)

- MXN: Mexico Inflation Rate (Sep)

- USD: US Initial Jobless Claims (w/e Oct 4); Fed Chair Jerome Powell & Fed Governor Bowman Speeches

- NZD: New Zealand Business NZ PMI (Sep)

Friday, Oct 10

- CHF: Swiss Consumer Confidence (Sep)

- CAD: Canada Unemployment Rate (Sep)

- USD: US Michigan Consumer Sentiment (Oct); Monthly Budget Statement (Sep)