This Week: USD Index Faces CPI, PPI, and Sales Data Test

- Critical US data defines USD Index week

- Key releases: December CPI, PPI, retail sales

- Fed scrutiny after DoJ investigates Chair Powell

- CPI outcome may pressure or rally USD Index

- PPI and retail sales data also cause USD volatility

A deluge of delayed and critical U.S. economic data may define the trading narrative for the US Dollar Index (USDInd) in the coming week.

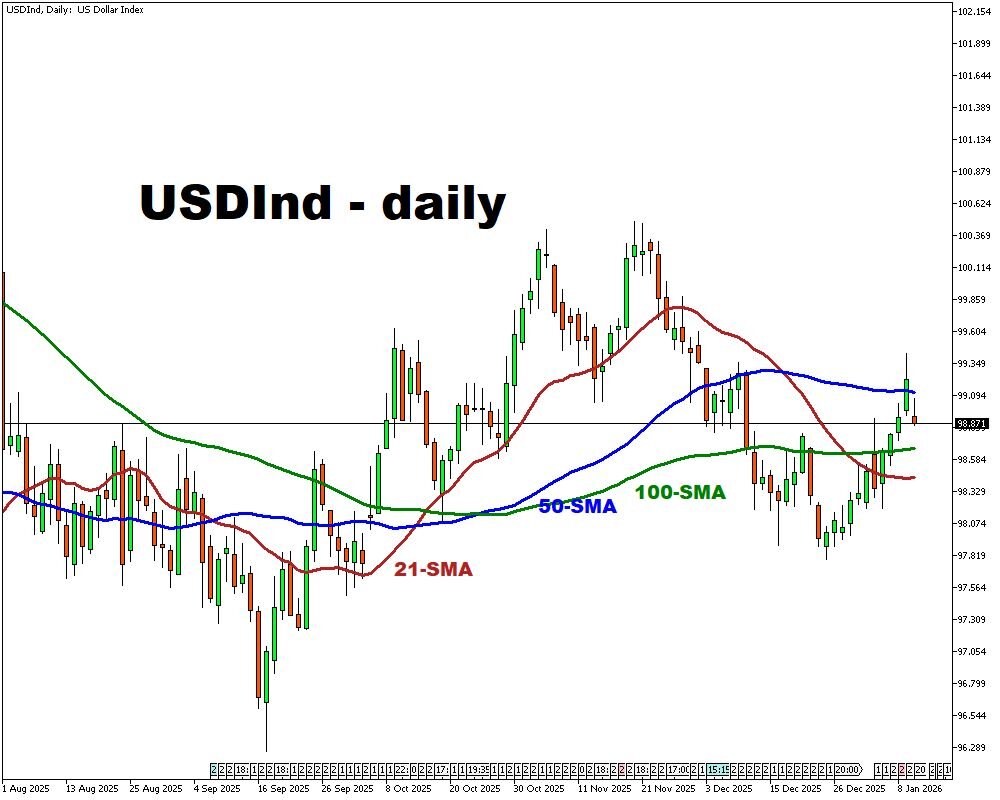

The index, currently near 98.8, faces consecutive releases of the December Consumer Price Index, a combined Producer Price Index report, and key holiday retail sales figures.

This economic calendar arrives as the Federal Reserve enters a period of heightened political scrutiny after the US Department of Justice has launched an investigation into the Fed Chair Jerome Powell.

Events Watchlist:

Tuesday, Jan 13: US Inflation Rate (Dec 2025) – USDInd

December CPI is the primary event, with the annual rate expected to be scrutinized against the prior reading of 2.7%. A print confirming continued disinflation could pressure the USD Index, while any reacceleration might trigger a rally.

Wednesday, Jan 14: US PPI (Oct & Nov 2025) – USDInd

The Bureau of Labor Statistics will release two months of Producer Price Index data together on this date. The combined read on pipeline price pressures will serve as a key input for future CPI trends, potentially causing USDInd volatility if the figures meaningfully diverge from expectations.

Wednesday, Jan 14: US Retail Sales (Nov) – USDInd

The October report showed a 0% MoM gain. Traders will assess if November spending maintained this momentum. Strong back-to-back data may support dollar strength, while weakness may fuel concerns and weigh on USDInd.

USDInd dynamics:

Other major events this week:

Monday, Jan 12

- USD: Fed Barkin and Fed Williams Speeches

- AUD: Australia Westpac Consumer Confidence Change (Jan)

- JPY: Japan Current Account (Nov)

Tuesday, Jan 13

- GBP: UK BRC Retail Sales Monitor (Dec)

- USD: US Inflation Rate (Dec); ADP Employment Change Weekly; New Home Sales (Sep & Oct); Fed Musalem & Barkin Speeches

- WTI: US API Crude Oil Stock Change (w/e Jan 9)

Wednesday, Jan 14

- CNY: China Balance of Trade (Dec)

- USD: US PPI (Oct & Nov); Retail Sales (Nov); Existing Home Sales (Dec); Fed Paulson & Williams Speeches

- WTI: US EIA Crude Oil Stocks Change (w/e Jan 9)

Thursday, Jan 15

- GBP: UK GDP (Nov); RICS House Price Balance (Dec); Goods Trade Balance (Nov); Industrial and Manufacturing Production (Nov)

- EUR: Germany 2026 GDP Growth; Germany Wholesale Prices (Dec); Eurozone Balance of Trade (Nov); Eurozone Industrial Production (Nov)

- USD: US Initial Jobless Claims (w/e Jan 10); Retail Sales (Dec); Business Inventories (Nov); Fed Barkin Speech

- NZD: New Zealand Business PMI (Dec)

Friday, Jan 16

- CAD: Canada Housing Starts (Dec)

- USD: US Industrial Production; NAHB Housing Market Index (Jan)

Sunday, Jan 18

- JPY: Japan Machinery Orders (Nov)