This Week: USDInd in focus amid crucial data

USDInd (US Dollar Index) faces a pivotal week with three major US economic releases. The data on consumer spending, the job market, and inflation will directly shape expectations for Federal Reserve interest rate policy, the primary driver of the dollar's value.

The dollar's reaction will hinge on whether the reports point to a resilient economy or one that is cooling.

Events Watchlist:

- Tuesday, Feb. 10: US Retail Sales (Dec)

Analysts forecast a MoM increase of 0.4%, following Nov 0.6% gain. A reading significantly above this consensus could signal economic strength, potentially supporting the dollar. Conversely, a flat or negative figure could raise concerns about economic momentum and weigh on the currency.

- Wednesday, Feb. 11: US Non-Farm Payrolls (Jan)

The market consensus is for the economy to have added approximately 68,000 jobs in Jan, with the Unemployment Rate holding steady at 4.4%. Avg Hourly Earnings are expected to rise by 0.3% for the month. A report exceeding these estimates could boost the dollar by suggesting the Fed may delay rate cuts. A figure well below the consensus estimate, may pressure the dollar.

- Friday, Feb. 13: US Inflation Rate - CPI (Jan)

The headline annual inflation rate is forecast to be 2.4%, with the core rate (excluding food and energy) expected at 2.5%. A reading higher than these levels could strengthen the dollar by pushing back expectations for rate cuts. A cooler reading, particularly in the core measure, could weaken it by suggesting underlying price pressures are easing more quickly.

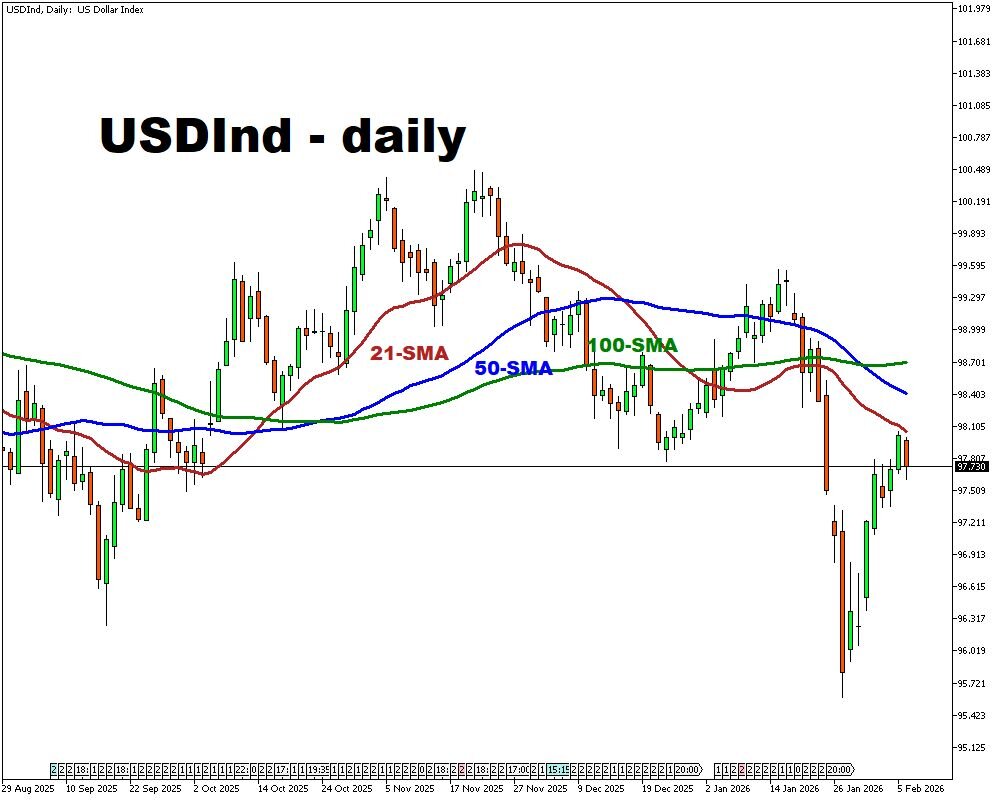

USDInd dynamics:

Other major events this week:

Monday, Feb 9

- MXN: Mexico Inflation Rate (Jan)

- AUD: Australia Westpac Consumer Confidence Change (Feb)

Tuesday, Feb 10

- GBP: UK BRC Retail Sales Monitor (Jan)

- AUD: Australia NAB Business Confidence (Jan)

- FRA40: France Unemployment Rate (Q4)

- USD: US Retail Sales (Dec)

- WTI/Brent: US API Crude Oil Stock Change (w/e Feb 6)

Wednesday, Feb 11

- AUD: RBA Hauser Speech

- CNY: China Inflation Rate (Jan), PPI (Jan)

- USD: US NFP (Jan), Unemployment Rate (Jan), Average Hourly Earnings (Jan)

- WTI/Brent: US EIA Crude Oil Stocks Change (w/e Feb 6)

Thursday, Feb 12

- AUD: RBA Hunter Speech

- GBP: UK GDP Growth Rate (Dec, Q4 2025), Business Investment (Q4), Goods Trade Balance, incl. Non-EU (Dec), Industrial Production (Dec), Manufacturing Production (Dec)

- USD: US Existing Home Sales (Jan), Initial Jobless Claims (w/e Feb 7)

Friday, Feb 13

- CNY: China House Price Index (Jan)

- GER40: Germany Wholesale Prices (Jan)

- EUR: Eurozone Balance of Trade (Dec), Employment Change (Q4)

- USD: US Inflation Rate (Jan)

Saturday, Feb 14

- CNY: China Current Account Preliminary (Q4), new Yuan Loans (Jan)

Sunday, Feb 15

- JPY: Japan GDP Growth Rate (Q4)