Week Ahead: US Dollar Index in Focus Amid Crucial Data

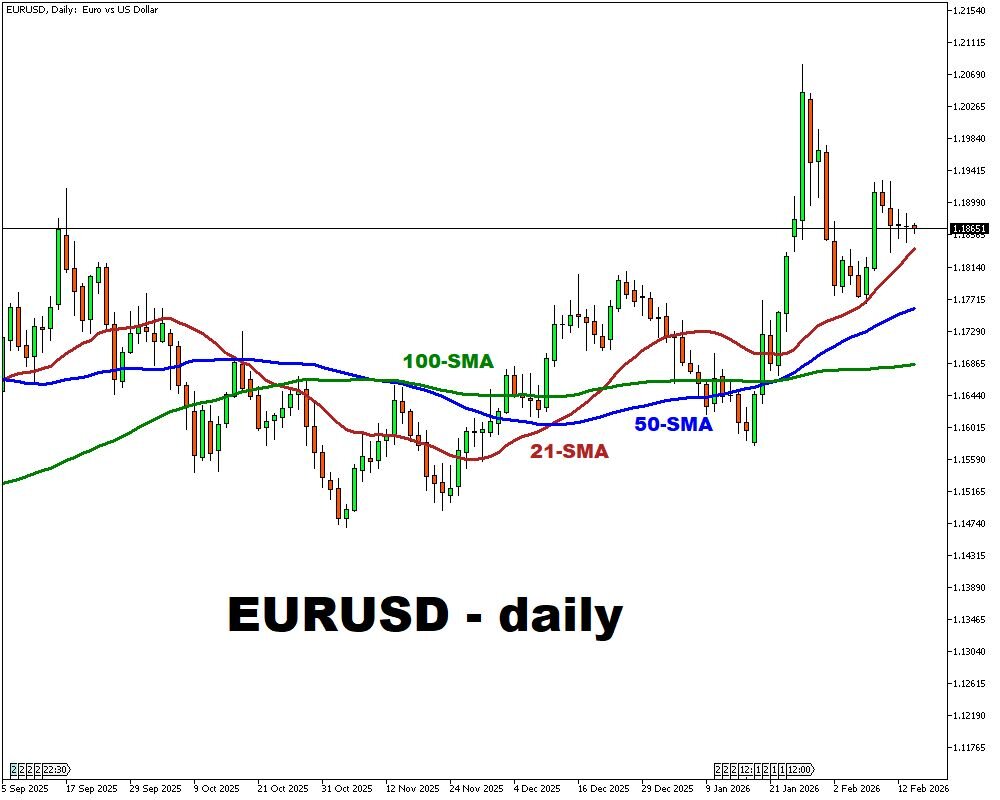

The EUR/USD pair faces a data-heavy week dominated by crucial U.S. economic insights. The primary focus will be on the latest U.S. inflation data and the detailed account from the Federal Reserve's last meeting.

These events will heavily influence the market's outlook for U.S. interest rates, which is a major driver of the currency pair. A stronger-than-expected U.S. economy could bolster the dollar, while signs of softening may support the euro.

Events Watchlist:

- Tuesday, Feb. 17: Germany ZEW Economic Sentiment Index (Feb)

This survey measures expectations for the German economy, a key driver for the Eurozone. A higher-than-expected number could signal improving confidence in Europe's largest economy, potentially offering support to the euro. A lower-than-forecast reading may weigh on the single currency.

- Wednesday, Feb. 18: FOMC Meeting Minutes (Jan Meeting)

The release of the minutes from the Federal Reserve's January policy meeting will be scrutinized for details on officials' views about inflation and the future path of interest rates. Markets will look for clues on the timing of potential rate cuts. Hints of a more cautious or "hawkish" stance from the Fed could strengthen the U.S. dollar. A more "dovish" tone, emphasizing patience, could put downward pressure on the dollar.

- Friday, Feb. 20: US Core PCE Price Index (Dec)

This is the Federal Reserve's preferred gauge of inflation, which excludes volatile food and energy prices. A reading that comes in higher than forecasts could be seen as delaying potential Fed rate cuts, likely boosting the U.S. dollar. A cooler-than-expected reading may fuel expectations for earlier rate cuts, which could weaken the dollar relative to the euro.

Other major events this week:

Monday, Feb 16

- EUR: Eurozone Industrial Production (Dec)

- CAD: Canada Housing Starts (Jan)

- CNY: China FDI (Jan)

- US Markets are closed: US President’s Day

- China’s Markets are closed (16-20 Feb): Lunar New Year

Tuesday, Feb 17

- AUD: RBA Meeting Minutes

- GBP: UK Unemployment Rate (Dec)

- EUR: Germany ZEW Economic Sentiment Index (Feb), Eurozone ZWE Economic Sentiment Index (Feb)

- USD: US ADP Employment Change Weekly, Fed Daly Speech

- CAD: Canada Inflation Rate (Jan)

- JPY: Japan Balance of Trade (Jan)

Wednesday, Feb 18

- GBP: UK Inflation Rate (Jan)

- USD: FOMC Minutes, US Building Permits (Nov, Dec), Durable Goods Orders (Dec), Housing Starts (Nov, Dec)

- JPY: Japan Machinery Orders (Dec)

- Crude (WTI, Brent): US API Crude Oil Stock Change (w/e Feb 13)

Thursday, Feb 19

- AUD: Australia Employment Data (Jan), S&P Global Manufacturing & Services PMIs (Feb)

- CAD: Canada Balance of Trade (Dec), New Housing Price Index (Jan)

- USD: US Balance of Trade (Dec), Initial Jobless Claims (w/e Feb 14)

- EUR: Eurozone Consumer Confidence (Feb)

- JPY: Japan Inflation Rate (Jan)

- Crude (WTI, Brent): US EIA Crude Oil stocks Change (w/e Feb 13)

- Major Earnings: Walmart (before market open)

Friday, Feb 20

- GBP: UK Retail Sales (Jan), S&P Global Manufacturing & Services PMIs (Feb)

- EUR: Germany HCOB Manufacturing, Services & Composite PMIs(Feb)

- CAD: Canada Retail Sales (Jan)

- USD: US PCE Price Index (Dec), GDP Growth Rate (Q4), Personal Income & Spending (Dec)